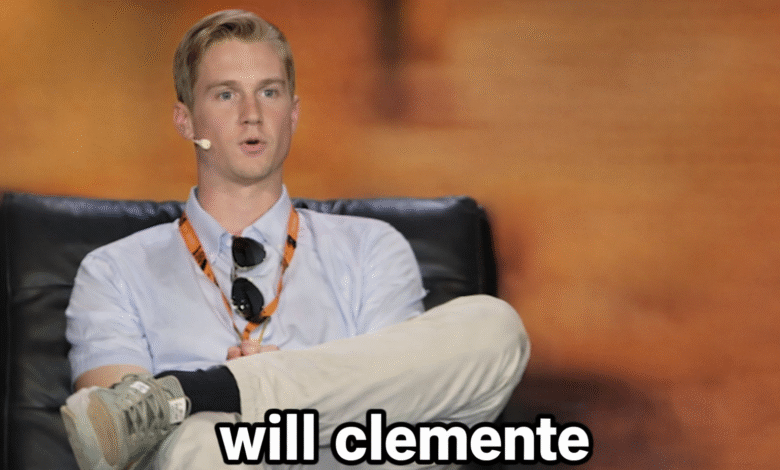

Will Clemente: The Visionary Bitcoin Analyst Transforming Crypto Insights

Introduction

Will Clemente has emerged as one of the most influential voices in the cryptocurrency space, known primarily for his deep insights into Bitcoin on-chain analytics. In a world where the crypto market can be volatile and often unpredictable, his research offers clarity to both retail investors and institutional participants. From analyzing blockchain data to interpreting market trends, Will Clemente provides a unique lens into the mechanics of Bitcoin, helping people understand the forces driving the largest digital currency.

While many analysts focus on price speculation, Clemente distinguishes himself by examining on-chain metrics such as transaction flows, exchange balances, and hodler behavior. His approach combines rigorous data analysis with accessible explanations, making it easier for followers to make informed investment decisions. Despite the complexity of blockchain technology, his commentary often simplifies concepts without losing analytical depth.

Quick Bio

| Category | Details |

|---|---|

| Full Name | William “Will” Clemente III |

| Birth Year | 2002 |

| Nationality | American |

| Education | BBA in Finance, East Carolina University |

| Profession | Bitcoin On-Chain Analyst, Crypto Researcher |

| Known For | Bitcoin On-Chain Analytics, Crypto Research |

| Notable Roles | Co-Founder of Reflexivity Research, Lead Analyst at Blockware Solutions |

| Estimated Net Worth | ~$5 Million |

Early Life and Education

Will Clemente was born in the United States in 2002. From an early age, he displayed an interest in finance and technology, gravitating toward the emerging field of cryptocurrency during his teenage years. His curiosity about digital assets led him to pursue a Bachelor of Business Administration (BBA) in Finance at East Carolina University, where he began exploring Bitcoin’s underlying mechanics in detail.

Although his formal education provided a strong foundation in finance, it was his personal interest in blockchain technology that truly shaped his career path. By the time he was in university, Clemente had already started analyzing Bitcoin on-chain data and sharing insights with online communities. His early exposure to both traditional finance and crypto research allowed him to develop a unique perspective that bridges the gap between conventional markets and digital currencies.

Career Beginnings in Crypto Analytics

Clemente’s professional journey began when he started sharing his Bitcoin research publicly on social media platforms. His analytical approach, which emphasized on-chain metrics rather than speculative predictions, quickly garnered attention from crypto enthusiasts and investors alike.

His first significant professional role came as a Lead Insights Analyst at Blockware Solutions, a blockchain analytics firm. In this capacity, he provided detailed research on Bitcoin trends, helping clients understand market behavior and long-term investment potential. This role gave him the credibility and exposure necessary to build a large following and establish himself as a thought leader in the field.

Founding Reflexivity Research

In September 2021, Will Clemente co-founded Reflexivity Research, a firm dedicated to institutional-grade cryptocurrency research. Reflexivity Research quickly became a recognized name for detailed analysis, providing insights into Bitcoin, macroeconomic trends, and market behavior.

The company’s research methodology emphasizes transparency, using raw on-chain data to inform conclusions rather than relying on speculation. While this approach has earned him praise for credibility and accuracy, it also comes with challenges. Crypto markets are inherently volatile, and even rigorous on-chain analysis cannot predict sudden market downturns, which sometimes leads to criticism from less informed audiences who expect guaranteed outcomes.

Expertise in Bitcoin On-Chain Analytics

Will Clemente’s expertise lies in interpreting blockchain data to uncover hidden trends in Bitcoin markets. This includes analyzing exchange inflows and outflows, tracking long-term holders, and evaluating mining activity. By focusing on the underlying metrics rather than market sentiment alone, he provides a grounded perspective that often contrasts with speculative narratives.

This analytical rigor has helped institutional investors and retail traders alike make more informed decisions. However, the reliance on historical blockchain data means that real-time market shocks or regulatory changes can still disrupt predictions. While Clemente’s insights reduce uncertainty, they do not eliminate the inherent risks of investing in cryptocurrency.

Influence and Thought Leadership

Clemente has become one of the most followed Bitcoin analysts on social media platforms, where he shares detailed charts, data interpretations, and market summaries. His followers appreciate his ability to explain complex concepts in accessible language, making him a bridge between technical blockchain research and everyday investors.

In addition to social media, Clemente has appeared on several crypto podcasts and online discussions, contributing to the broader understanding of Bitcoin market dynamics. His influence has helped raise the profile of on-chain analytics as a serious research discipline, encouraging more transparency and informed decision-making in the cryptocurrency ecosystem.

Positive Contributions

One of Will Clemente’s key strengths is his commitment to providing data-driven insights that enhance investor education. By emphasizing transparency and analytical rigor, he helps reduce misinformation in a market often dominated by hype and speculation.

Moreover, his ability to simplify technical blockchain concepts makes cryptocurrency more approachable for newcomers, expanding the market’s accessibility. This positive impact fosters a more informed investor base, which can contribute to healthier market behavior over time.

Criticisms and Limitations

Despite his success, Clemente faces challenges inherent to crypto research. On-chain metrics, while informative, cannot fully predict sudden market volatility or the impact of unforeseen regulatory changes. Some critics argue that relying heavily on historical data may give a false sense of security to less experienced investors.

Additionally, the fast-moving nature of cryptocurrency markets means that even well-researched insights may become outdated quickly. This limitation is not unique to Clemente but applies broadly to all forms of crypto analysis. Understanding these constraints is crucial for followers who may otherwise overestimate the predictive power of on-chain metrics.

Conclusion

Will Clemente represents a new generation of cryptocurrency analysts who combine financial expertise with technical blockchain knowledge. Through his work at Reflexivity Research and his public presence, he has contributed significantly to the understanding of Bitcoin on-chain metrics.

While his insights provide clarity and guidance in an otherwise volatile market, followers must remember that crypto investments carry inherent risks that no analysis can completely eliminate. Overall, Clemente’s analytical approach, thought leadership, and commitment to transparency have positively shaped the landscape of cryptocurrency research.

FAQ

Who is Will Clemente?

Will Clemente is an American Bitcoin analyst known for his expertise in on-chain metrics and cryptocurrency research.

What is Will Clemente’s main area of expertise?

He specializes in Bitcoin on-chain analytics, focusing on transaction flows, exchange activity, and long-term holder behavior.

What companies has Will Clemente founded?

He co-founded Reflexivity Research, a firm providing institutional-grade crypto insights, and previously worked as Lead Insights Analyst at Blockware Solutions.

How does Will Clemente influence the crypto community?

He simplifies complex blockchain data for both retail and institutional investors, helping them make informed decisions.

What are the limitations of Will Clemente’s analysis?

His insights rely on historical blockchain data and cannot fully predict sudden market volatility or regulatory impacts.